Michael Ellenhorn is the Founder & CEO of Decipher. Mr. Ellenhorn helps clients create safer, more productive and more profitable workplaces through reliable investigative intelligence.

Good Turnover or Bad Turnover? Four Ways to Analyze Your Firm

The average turnover for AmLaw 200 firms is 26.3 percent, according to analysis by Decipher Investigative Intelligence—so simply put, for every four lawyers at your firm, one will swap out every year.

“Turnover” can be a loaded term, and one that is frequently misunderstood. Let’s start with the math: To determine the state of turnover in the legal profession, Decipher examined every firm in the AmLaw 200 to chart lawyer hires and departures over the past four years.

This total accounts for a firm’s total “volatility”—the sum of people entering and exiting. We then divide the volatility by the firm’s total headcount; this resulting turnover rate measures the extent of change happening in a given year.

This is the best way to think about turnover: a measure of the change happening to a firm, its roster and its culture. Just like change itself, turnover is not inherently “good” or “bad,” as two firms with dramatically different circumstances can have the same score. Consider two firms, both with 1,000 lawyers:

- Firm A is widely known for having a collaborative culture; in a given year, no one leaves, but it acquires a team of 300 lawyers, all with portable business and positive attitudes.

- Firm B loses its entire corporate practice—300 lawyers strong—in a dramatic exit that generated dozens of headlines and lost far more clients.

Both have the same turnover rate: 30 percent.

So, to assess your own turnover, you can start with the quantitative, but it’s imperative that you dive into the qualitative. While the specifics will vary for every firm, here is a helpful approach to better understand (and act upon) turnover at your firm.

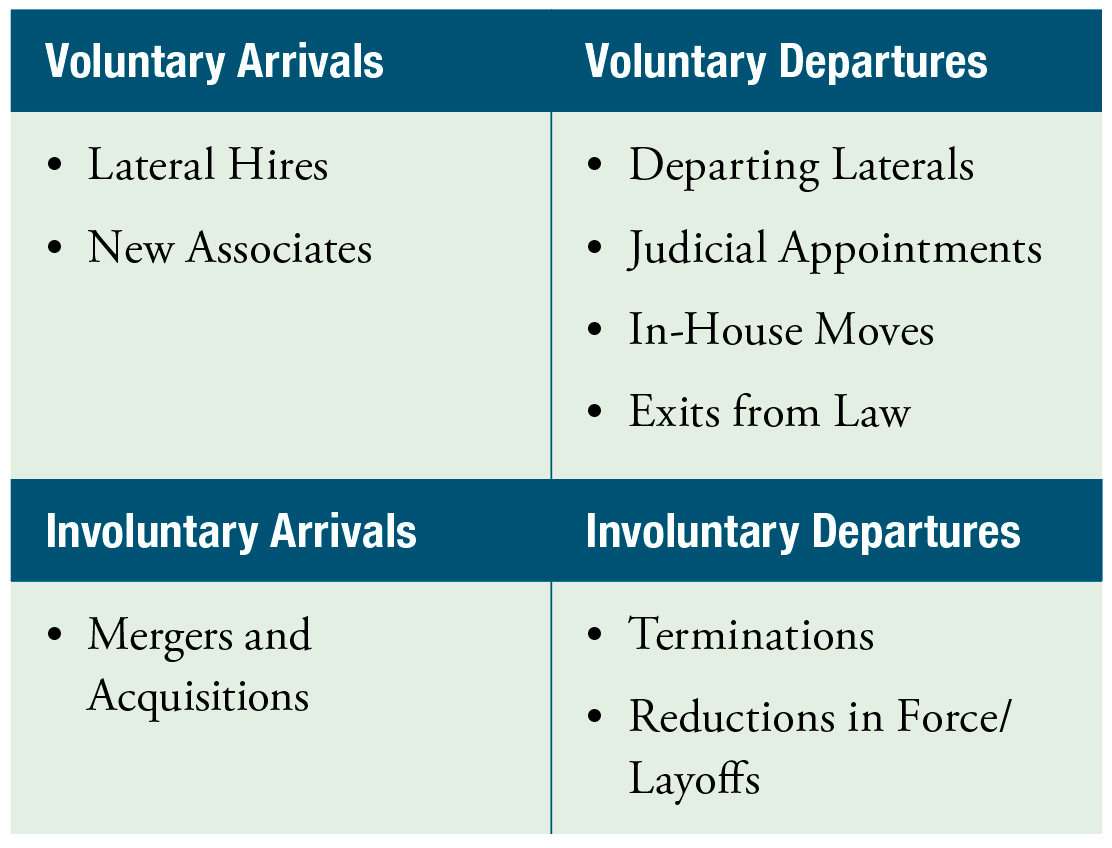

Start with a straightforward sort. Compile lists of all lawyers who joined and left your firm within a given year. From there, it’s helpful to further segment:

- Voluntary:

Lawyers who joined or left of their own accord.

- Involuntary: Lawyers whose decision was guided by other forces; in addition to terminations and layoffs, this can include mergers or acquisitions, as 99 percent of the individuals acquired were not directly involved in the negotiation.

-

Each segment can prompt meaningful questions about the true state of your turnover.

Voluntary Arrivals

These are the people who chose your firm over their other options. This should be the “fun” sector (provided you find data analysis fun) … but the enthusiasm of new laterals can be soured later by false promises or bad cultural fits. When 75 percent of lateral hires fail or leave their firms within five years, it’s imperative to approach this sector with cautious optimism.

While it may be too early to truly understand the health of this sector, take into account these key considerations as you shape next year’s list:

Let the right ones in. Does the firm have a documented talent strategy that aligns with its business goals—or is lateral recruitment vulnerable to the “I know a guy” approach? Is the firm easily distracted by the “shiny object” rainmaker or group that enters the proverbial transfer portal?

Beyond having a strategy that keeps your prospects on target, what kind of due diligence does the firm perform to scout red flags (financial, professional or reputational) and verify business?

Protect the investment. It takes considerable time and effort to recruit high-performing laterals—and it’s even more costly to replace them; the average cost to replace a failed AmLaw 100 partner is now $2.3 million.

How effectively are you onboarding laterals within your firm? Do you help them build ties to other lawyers and the key professional staff who will support their practice? Do you use the products of due diligence for good, like by making warm introductions to fellow alumni of a given college or university?

Voluntary Departures

Who left your firm, and where did they go? Like turnover, this can be “good” or “bad,” with a range of effects, from the positive (in-house counsel positions at current or prospective clients, prestigious judicial appointments) to the negative (lawyers moving to a competing firm).

In this sector, for the sake of your market share and potential lessons learned, spend most of your time studying the attorneys who jumped ship to a competitor. Consider:

- Favorability. Some of your dearly departed may be sorely missed; others, less so. Take an honest assessment of your list. Are you losing people who self-select out as bad fits (culture, skills, experience), or are you losing your star players? If the first category exceeds the latter, this needs your attention now.

- Patterns. Categorize your departing lawyers so you can spot trends and identify issues early. Look for disproportionate exits by:

- Practice area

- Client team

- Supervising partners

- Office location

- Experience level

- Demographics

This can shine a light on toxic supervisors, untenable client situations, and more—and will help you act quickly to protect your talent and culture.

Involuntary Arrivals

Again, these are the people who arrived at your firm as the product of a merger or acquisition—a decision out of the hands of 99 percent of people affected.

Just as they have a major impact on a firm’s turnover numbers, mergers and acquisitions bring considerable change for all involved. Your new colleagues deserve empathy as they adjust to a new environment while they may be in professional mourning for what was. How warmly have they been welcomed? How effectively have they been onboarded? Have they been meaningfully included into their new environment, or are they continuing to operate independently, with few ties to the new firm?

If you are studying your turnover from the past year, there’s still time to take corrective action with your Involuntary Arrivals—before they become this year’s Voluntary Departures.

Involuntary Departures

This final sector includes individuals subject to layoffs or RIFs, as well as lawyers who were terminated for cause.

Regarding your RIFs, it’s a fair assumption that when firms in the legal profession take such a drastic measure, they do so with prudence, ensuring they avoid disparate impacts to any demographic. Nevertheless, it’s essential to review your layoff protocols to ensure any such measures are done above board and without bias.

Terminations are best understood on a case-by-case basis and with ruthless candor. What went wrong, and what could we have done better?

A Decipher survey presented the reasons law firms reported losing lateral partners:

- Failing to bring the promised book of business—70 percent

- Inability to develop new client relationships—56 percent

- Cultural fit issues—29 percent

- Client conflicts—21 percent

- Lack of required expertise—19 percent

- Behavior issue with junior lawyers or professional staff—10 percent

- Actions believed unethical or potentially illegal—8 percent

A comprehensive due diligence program could prevent these losses.

While simple measures like insisting on a complete Lateral Partner Questionnaire can thwart conflict issues, firms cannot stop there; almost every candidate screened by Decipher has inflated some client section of the Lateral Partner Questionnaire.

Meaningful due diligence means going beyond a check-the-box background check and a perfunctory LPQ; it means using both quantitative data and human intelligence to accurately assess a candidate’s business skills, work style and character.

And it’s more important than ever: As law firm hiring has slowed in 2023, the candidate pool is more laden with risk. Among the candidates screened by Decipher in Q1 of 2023, 84 percent had red flags, meaning eight in 10 prompted concern for a personal legal history, disciplinary history, undisclosed entanglement, undisclosed business affiliations, troubling social media ... or a combination thereof.

Across all sectors, moving your firm’s turnover to “good” takes a consistent commitment to act with purpose:

- To ensure the right Voluntary Arrivals with adherence to a business-driven talent strategy.

- To course-correct your Voluntary Departures by monitoring trends and acting early to prevent additional losses;

- To help Involuntary Arrivals adjust and feel truly included; and

- To minimize Involuntary Departures through due diligence that prevents problematic hires in the

first place.